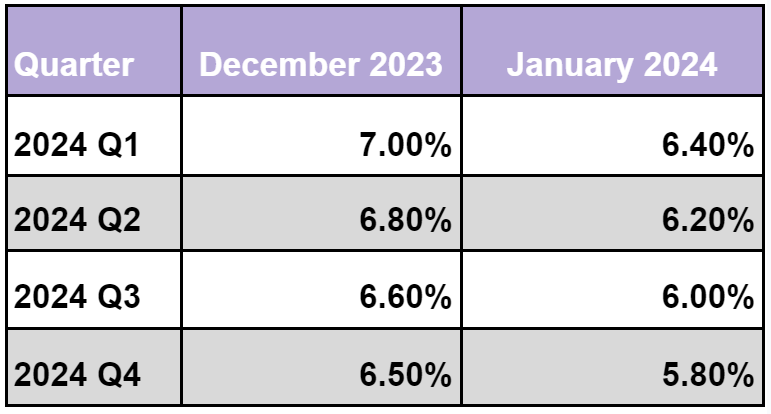

Mortgage Rates Predicted To Drop Below 6% In 2024

Understanding Mortgage Rates

When buying your first home, a mortgage will likely be the largest loan that you have ever taken out. When deciding which lender to choose, it’s important to understand what factors contribute to mortgage rates and how to differentiate between the various options. Mortgage rates determine how much interest you will owe annually on the loan as a percentage of your total loan balance. For example at a 6% fixed rate on a loan of $250,000 you would end up owing $15,000 annually or $1,250 monthly to cover the interest on the loan.

Determining Factors

There are a variety of contributing factors that will affect what rates mortgage lenders will offer you, and these can be largely separated into two categories. There are personal factors that are associated with an individual, and economic factors that affect the country at large. Both can have a significant effect on available mortgage rates. Larger scale economic factors include the strength of the economy, inflation rates, employment rates, consumer spending, federal policy, government bond prices, and local housing market conditions. Personal factors like credit score, credit history, the size of your down payment, your debt to income ratio, loan to value ratio, and the type of loan also play a big role.

In general to receive an ideal rate:

- Maintain a credit score of 760 or higher

- Agree to a downpayment of at least 20%

- Maintain a low ratio of debt to income

- Maintain a low ratio of loan balance to home value

Looking for a new home? Check out this delectably spacious, open floorplan of this new construction at 3767 Durness Way.

Types of Mortgage Rates

Fixed Rate Mortgages, as the name suggests, have fixed interest rates that will remain consistent for the entirety of the lifetime of the loan. This timeframe is typically 15 or 30 years, which makes this option a reasonable choice for home buyers that plan on living in the home for a long period of time. The disadvantage of these types of loans is that they typically charge higher interest rates than those with adjustable rates.

Adjustable Rate Mortgages (ARMs) Tend to start out with more favorable interest rates, making them more enticing to people that expect to move within a few years. Typically ARMs maintain a fixed rate for a certain number of years, after which the interest rate adjusts based on the current housing market. For example with a 10/6 ARM, the interest rate would remain constant for the first 10 years. After this time, the rate can adjust every 6 months. ARMs are available at a variety of different lengths and adjustment intervals, but they all share the same risks. If interest rates substantially increase by the time that the mortgage becomes adjustable, it is possible that the homeowner could end up being priced out by the elevated interest rates.

This stunning rooftop view at 1310 Bingham St could be yours! Schedule a tour while it’s still on the market.

What Does This Mean For You?

The predicted drop in mortgage rates indicates a shift in the market, suiting home buyers. As rates decrease, buyers’ purchasing power goes up. In other words, as prospective buyers are required to spend less on interest rates, they will be able to afford a nicer home. With the market beginning to shift in the favor of home buyers, now is an ideal time to start looking for your dream home. Finding the perfect home in the modern housing market can be quite difficult and generally takes a fair bit of time, so getting the process started today will ensure that you can capitalize on low mortgage rates as they decrease over the coming months. Be sure to reach out to your local Circa Real Estate agent to find your perfect home while the market is in your favor!

Looking For A Home?

Check out these active listings!

8226 Longear Ln

$384,900

3 Bedrooms – 2 Full & 1 Half Baths

2,376 Sqft – Built 2021

126 Amundsen St B

$429,900

3 Bedroom – 2 Full & 1 Half Bath

1,814 Sqft – Built 2023